irs child tax credit problems

These credits can be claimed by. Letter 6416 Letter 6416-A Letter 6419.

Reports Show That The Irs Has Mistakenly Paid Out Billions In The Past Decade To Identity Thieves And People Who Fraudulently Claim Tax Debt Irs Taxes Tax Help

The White House has put a temporary pause on the IRS Child Tax Credit tool Politico reported on March 3.

. Child Tax Credit. The first potential glitch of tax season involves new concerns about the accuracy of some letters that the IRS is sending out relating to the child tax credit. If you are claiming the nonrefundable child tax credit refundable child tax credit additional child tax credit or credit for other dependents complete Schedule 8812 and attach it to your Form 1040 or 1040-SR.

Currently its a 1000 nonrefundable. The Internal Revenue Service said it is reviewing complaints by some taxpayers who say that the IRS Letter 6419 sent to them spells out the wrong dollar amount for what the families. To get started you can call 800-829-1040 to reach the tax agency about.

Advanced Child Tax Credit ACTC Letters. The IRS says you may be waiting on hold for an average of 13 minutes and that wait times are higher on Monday and Tuesday. STOP You cannot take the child tax credit or credit for other dependents on Form 1040 or Form 1040SR line 13a or Form 1040-NR line 49.

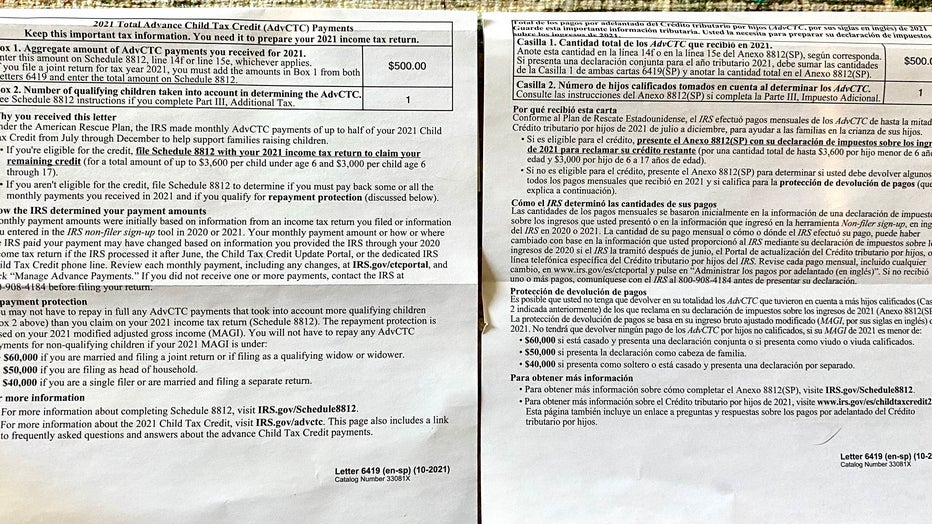

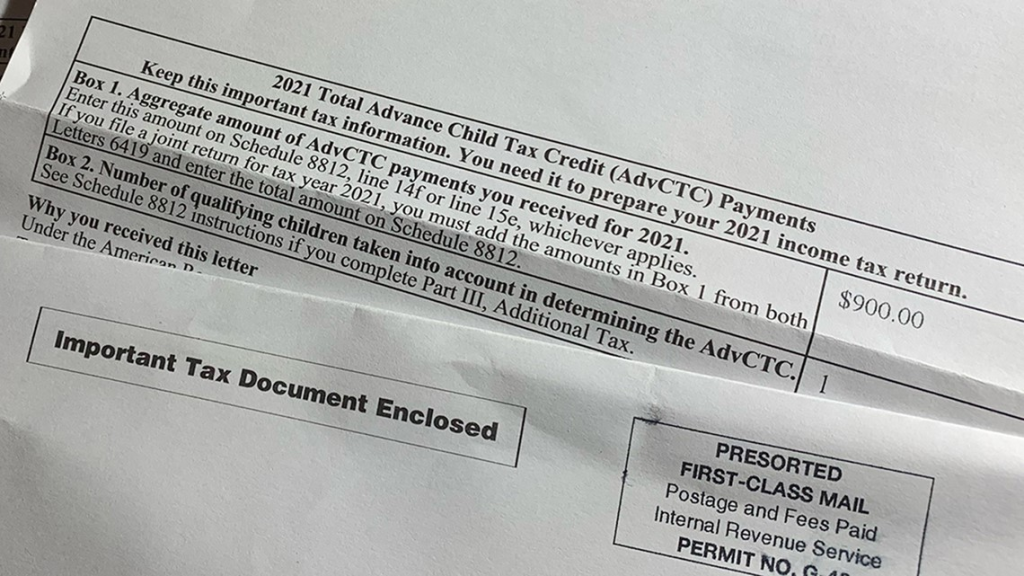

The first potential glitch of tax season involves new concerns about the accuracy of some letters that the IRS is sending out relating to the child tax credit. A tax credit reduces your tax liability dollar-for-dollar. This tax season parents and families will need to pay special attention to their filing in order to reconcile the child tax credit amounts they may or may not have received throughout 2021The IRS has sent out a letter to families Letter 6419 detailing the amount of money taxpayers received last year in terms of advance payments.

In the year 2021 following the passage of the American Rescue Plan Act of 2021 it was temporarily raised to 3600 per child. LITCs can represent taxpayers in audits appeals and tax collection disputes before the IRS and in court. IRS 1040 Schedule 8812 Instructions is not the simplest one but you do not have reason for panic in any case.

Congressional Research Service. Owe Money To The IRS. Yes even if you dont file taxes by the deadline or dont owe taxes April 18 is not the last chance to claim child tax credits or the earned income tax credit.

LITCs represent individuals whose income is below a certain level and who need to resolve tax problems with the IRS. New parents should keep checking the Update Portal for the new. You must combine the total amounts shown in box 1 of both IRS Letters 6419 when you file your federal income tax return this year.

Apply for Employer ID Number. Internal Revenue Service IRS. Advance Child Tax Credit CTC A word of caution to all married parents filing a joint return for tax year 2021 who received advance Child Tax Credit CTC payments in 2021.

Parents of children ages 6 to 16 also got an increase to 3000 per child in 2021 from 2000 the year before. The credit for 2021 increased to 3600 per child under age six from 2000 in 2020. If you claimed married filing joint status on the tax return.

This means that a 500 tax credit actually takes 500 off your tax balance due. Generally people who earn less than 12400 individually or. The credit is often linked to the number of dependent children a taxpayer has and sometimes the taxpayers income level.

The child tax credit is worth up to 3600 per child in 2021 and eligible filers can receive half their credit in advance through automatic monthly. The IRS has not announced a separate phone number for child tax credit questions but the main number for tax-related questions is 800-829-1040. Instead of calling it may be faster to check the.

You also cannot take the additional child tax credit on Form 1040 or Form 1040SR line 18b or Form 1040-NR line 64. According to the tax agency the Child Tax Credit portal was built out as an online app that allows non-filers to report basic information in order to still receive their child tax credit payments. Child Tax Credit 4 Accessed June 07 2021.

For example in the United States only families making less than 400000 per year may claim the full CTCSimilarly in the United Kingdom the tax. A child tax credit CTC is a tax credit for parents with dependent children given by various countries. If you are using a screen reader and are having problems using this website.

IRS Tax Brackets Deduction Amounts for Tax Year 2021. The Child Tax Credit is given to taxpayers for each qualifying dependent child who is under the age of 17 at the end of the tax year. The United States federal child tax credit CTC is a partially-refundable tax credit for parents with dependent childrenIt provides 2000 in tax relief per qualifying child with up to 1400 of that refundable subject to an earned income threshold and phase-in.

But this tax season might be an outlier due to the impact of expanded Child Tax Credits CTC that were put into place last year USA Today reported. Child Tax Credit CTC It is in addition to the credit for child and dependent care expenses on Schedule 3. When the tax period started unexpectedly or maybe you just forgot about it it could probably create problems for you.

The IRS said it will be offering families the ability to add children born or adopted in 2021 to its Child Tax Credit Update Portal. Complete the rest of your Form 1040 Form 1040SR or Form 1040-NR checkbox Yes. The Internal Revenue Service said it.

A tax deduction on the other hand reduces your taxable income and is equal to the percentage of your marginal tax bracket for example if youre in the 10 tax bracket a 500 tax deduction will.

Irs Issues Confusing Advice On Reconciling The Child Tax Credit

Advance Child Tax Credit Filing Confusion Cleared Up

Child Tax Credit Portal Why Is The Irs Closing Its Ctc Tool Marca

How To Call The Irs With Tax Return And Child Tax Credit Questions Cnet

What Is Irs Letter 6419 And Why Does It Matter Before You File Taxes Where S My Refund Tax News Information

How I Became An Accountant From An Unlikely Beginning To An Rewarding Career Lessons Learned In Life Lessons Learned Enrolled Agent

Did Your Advance Child Tax Credit Payment End Or Change Tas

Child Tax Credit 2021 Irs Chief Warns Payments May Be Delayed Abc7 San Francisco

Irs Faces Backlogs From Last Year As New Tax Season Begins Npr

Irs Delayed Refunds Due To Tax Credit Math Errors Fingerlakes1 Com

Irs Notice Cp79 We Denied One Or More Credits Claimed On Your Tax Return H R Block

Tax Tip Returning A Refund Eip Or Advance Payment Of The Ctc Tas

Tax Day Deadline In 3 Weeks What Happens If You File A Tax Extension Tax Extension Tax Refund Filing Taxes

If You Got The Child Tax Credit In 2021 You May Pay In 2022 Wsj

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Irs Increases Standard Mileage Rates For 2013 Small Business Trends Debt Relief Programs Internal Revenue Service Tax Relief Help

Child Tax Credit Update What Is Irs Letter 6419 Gobankingrates

2021 Child Tax Credit Advanced Payment Option Tas

Tax Tip Caution Married Filing Joint Taxpayers Need To Combine Advance Child Tax Credit Payment Totals From Irs Letters When Filing Tas